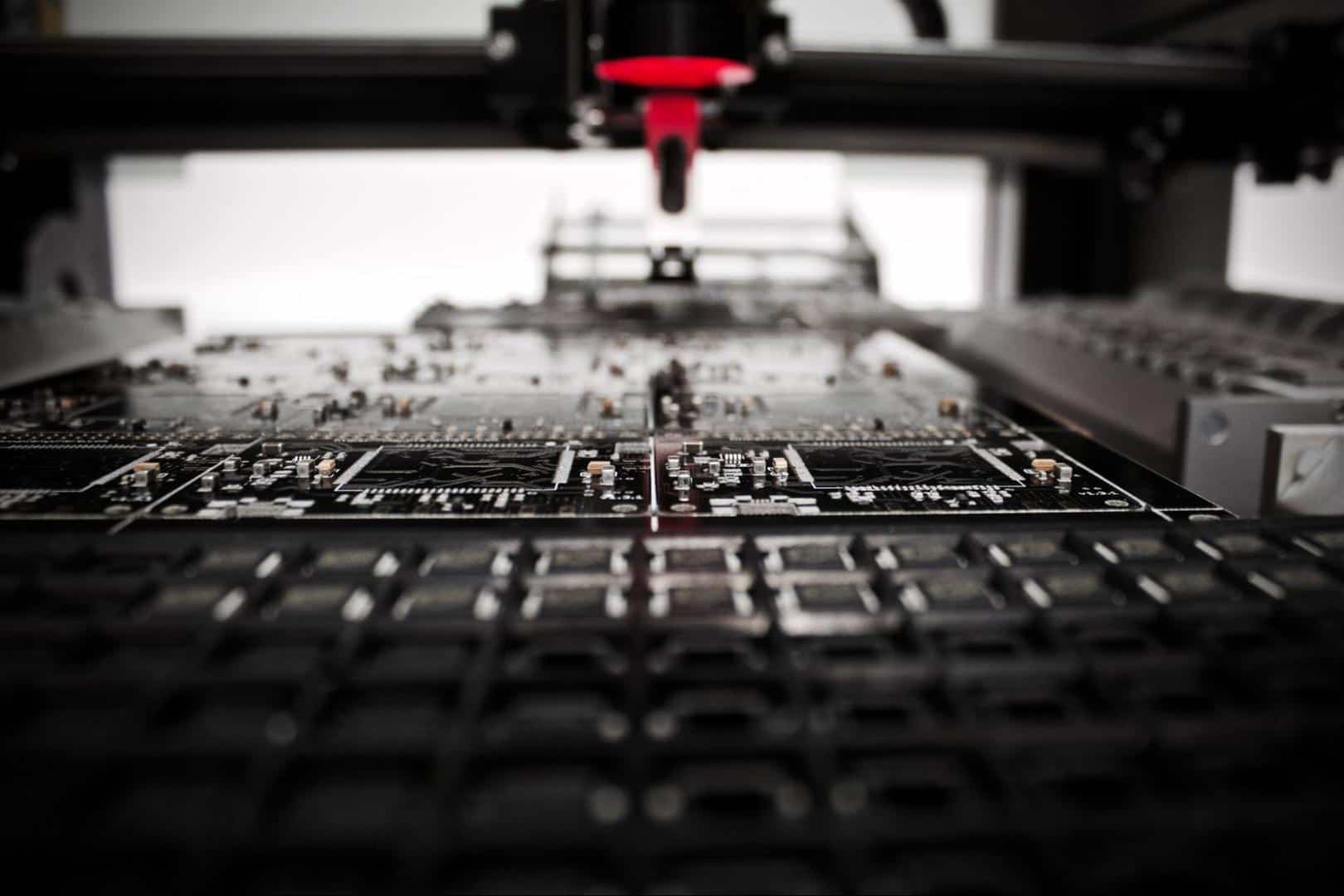

Photo: Louis Reed

Manufacturing accounting differs greatly from accounting in other industries. The professionals, strategies and software you use are the keys to the continual success of your organization.

There are many moving parts, literally and figuratively, that need to be monitored and optimized in order to experience the results you expect.

For example, you could be making toys or building advanced testing machinery for midstream petroleum companies. Regardless of what your company manufactures, one of your objectives is to increase your revenue.

The only way that happens is through an in-depth, dynamic understanding of your costs, the state of your inventory and your manufacturing overheads.

This analysis can get overwhelming when you put it all together. It’s easy to get bogged down in terms, resulting in paralysis by analysis.

A great place to start your understanding is by getting answers to some key financial questions often asked by business owners.

Accounting for Manufacturing Businesses

The basics of accounting for Manufacturing

Successful accounting practices in manufacturing businesses are like anything else; you lay a strong foundation and build from there. Here are some important accounting and manufacturing terms.Inventory

Direct Material Inventory refers to the raw material you use to manufacture your products. For a computer manufacturer, this includes the hard drives, screens, individual plastic keys for the keyboard and everything else that can be directly tracked back to manufacturing the computer. Some companies use a perpetual inventory tracking method to track direct material. Each piece involved in building the item has a barcode that is scanned when it is received into inventory. The barcode is scanned again when that piece is used to build the item. This is an effective method when you are working with more expensive materials. You could also use a periodic inventory tracking system. The problem with this is it’s only accurate when inventory is counted by hand, which leads to increased labor costs and potential disruption to operations. Work-in-Process Inventory is any item in the process of being made. Imagine your production line stopping at midnight at the end of your fiscal year. These are the products between the beginning and the end of the line. Finished Goods Inventory are the completed items that have not yet been sold. |Overheads

In most cases, WIP and finished inventory should include manufacturing overheads. This provides a more accurate representation of the cost to manufacture a product.

Examples of overhead costs include facility rental and utility costs, repairs and maintenance, and any labor that is indirectly involved with making your product.

Photo: Freepik

Manufacturing Cost Accounting Methods

Depending on the type of operation you run, you may use one or more of the following costing methods:

Standard Costing is a system where standard rates are established for material and labor costs. This system will allow you to see the trends of your business. This method is effective if you are producing large amounts of a product repetitively.

Job-Costing is more effective if you make your products to order. Your inventory will be on your books for a shorter period of time and you will experience bursts in labor. This method will allow you to see accurate margins for individual projects.

Activity-Based Costing assigns costs to “activities” and is similar to job-costing but it takes more indirect costs into account. This method can help you recognize which projects are more profitable. It’s also especially helpful if you have a wide range of products.

This is not an exhaustive list, but it is a solid starting point for implementing an accounting system.

Your Reliable Partner for Accounting for Manufacturing Businesses

Get insight that goes beyond the numbers with support from our fractional CFOs.

How a Fractional CFO Optimizes Accounting for Your Manufacturing Business

Implementing solid accounting practices for your manufacturing business validation allows you to see into the future. You will be able to forecast where your business is going so you can make adjustments in the present.

If you feel that you need assistance with accounting for a manufacturing business, you’re not alone.

Figuring out which methods to use could feel overwhelming for you. But the numbers matter and must be reported on your financial statement and understood by a professional.

That’s the advantage of using a fractional CFO. They can sift through the options and optimize these processes for you. Accounting for manufacturing businesses is one of our main areas of expertise at Michigan CFO Associates.

We spend the necessary time to understand the nuances of your manufacturing business. We know that each organization presents its own unique mixture of factors and problems.

Our CFOs then help you choose and implement the process that will provide the greatest cost/benefit value for informed decision making in your organization. Clearly understanding your costs is critical in manufacturing businesses.

Our goal is to give you the freedom to run your business with the accurate financial information you need to guide it into the future.

Still not sure if you need a CFO? Contact us today!