By Tom Carbone, Senior Financial Analyst

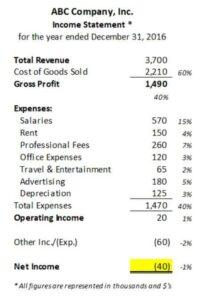

As a small business owner, have you ever asked your bookkeeper or controller to provide you with an income statement and felt like you’re reading a foreign language? Your eyes probably wander directly to the bottom line. “Hmm…how much money did we make? What!? We had a $40,000 loss? That can’t be right!?!” Then you look at all the rest of the numbers on the page and you’re still not sure why. “Cost of Goods Sold? Gross Profit? Expenses? Where did we go wrong? More importantly, WHY did we lose money?”

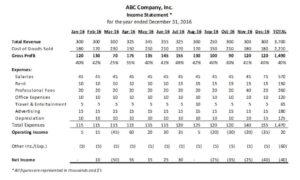

Your first step in unlocking the mystery behind your financials is to go back to your bookkeeper and ask her for the income statement in a columnar format by month. Better yet, ask her for a one page print out of the report. Even better, ask for it on 11×17 paper so you can read it easily! Your report should look similar to the following:

Start reading left to right, top to bottom on the report. Your top line figure should read Revenue, Sales, Income, or something similar. Here’s where the horizontal analysis begins!

What does your monthly revenue look like? Roughly $300k per month in this example. Are there spikes or dips? Is that typical? Perhaps it is if your business is seasonal. All the way to the right on the top line can see your annual (or YTD) revenue number. Is that what you expected? If so, great. If not, which month does it start to appear to have gone off course? Let’s dig into the detail for that month and see what we find.

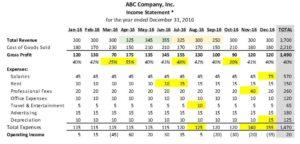

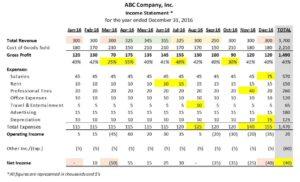

Just underneath the Cost of Goods Sold section, you should see the Gross Profit line. What does your Gross Profit look like as a percentage of Sales? What do you target in your quotes? Maybe you expected 40% for the year, but do you see consistency across the months? If you see erratic gross margins month to month, that’s almost a sure sign that there’s a fundamental problem with your accounting data. Perhaps direct costs are getting booked in the wrong periods or maybe administrative expenses are getting mixed in with direct costs. Either way, you’ve isolated a problem and can investigate further. The mystery keeps unfolding!

Further down the page, you should see the rest of the operating expenses incurred in running your business. On average, what are your monthly operating expenses? $115k? Any spikes or dips here? If so, what months are you seeing those? Were bonuses given out in December? Was there a Rent increase in July? Did you receive a significant legal bill in November? Did your salesperson travel to the Bahamas for business in August? By asking and getting answers to these questions, you continue to unlock the mystery!

Now you’re left with the bottom line. What months were you profitable and when did you lose money? Take a look at a few months with the similar amounts of Revenue and see how the bottom line compares. For instance, Jan Mar & Dec have the same sales – but the Net Incomes are all different. Why is that? This will further unlock the mystery as to why you made or lost money in any particular month.

See what you’ve discovered by just viewing the same information over several periods rather than all at once? You still might not be happy with the result but at least you are finding out WHY.

Looking back, you might think, we need to dig a little deeper into Cost of Goods Sold to find out why there’s a lack of consistency. Perhaps those bonuses weren’t warranted last year. Maybe, we should have rethought our salesperson’s trip to the Bahamas.

Keep in mind: If your accounting data is unreliable, then garbage in, garbage out. Your financials will be useless as the management tool they were intended to be. On the other hand, if your accounting data IS reliable, then the mystery should unfold rather quickly. You should easily be able to locate those nuances that are causing any month to be less than profitable. Your financials should communicate a clear story, not an unsolved mystery!

Subscribe to our blog for more practical, small-business financial tips.

For more information please contact us at info@michiganCFO.com.