Regain Control Over Your Numbers With the Best Virtual CFO Services

Grow your small business in a healthy, intentional way with our experienced virtual CFOs

Why work with our virtual chief financial officers?

- Accurate, timely and useful reporting

- In-depth pricing and margin analysis

- Forecasting and budgeting

- Rolling cash planning

- Strategic decision support

- Staff development and mentoring

- Virtual CFO rates are a fraction of a full time CFO’s

What Our Clients Are Saying About Our Remote CFO Services

Rave Computer

Maestro Turgeon Group, LLC, Madison Heights, MI

B&P Process Equipment & Systems, LLC Saginaw, MI

Our Virtual CFO Services for U.S. Businesses

Looking for reliable small-business virtual CFO services?

Michigan CFO Associates can help.

Benefit from our proven methods of addressing the financial needs of small business owners in a cost-effective way

Deep Industry Knowledge

Our virtual CFOs have a deep manufacturing background and understand the solutions you need

Regain Control of Your Numbers

With accurate and timely financial data from our virtual CFOs, you control the numbers, not vice versa

Experience That Makes a Difference

Backed by over 15 years in the virtual CFO market, you can always depend on our expert CFO services

Your Strategic Financial Partner

Our virtual CFOs provide leadership, training, mentorship and consulting for your accounting staff

A Valuable Member of Your Team

Your virtual CFO seamlessly integrates into your team to provide holistic support

By the Numbers

18

Years in business

230+

Clients served and counting

3.9 Years

Average time clients work with our Virtual CFOs

9.6

NPS score from our clients

Grow Your Business in a Healthy Way With virtual CFO Services

Bring clarity to your numbers and improve financial decision-making at a fraction of the cost of a full-time CFO.

Benefits of Hiring a Virtual CFO

Affordable Financial Leadership

Bring clarity to your finances and transform your decision-making from reactionary to intentional with our reliable virtual CFO services.

- Customized to Your Financial Needs

Our experienced virtual CFOs take the time to align with your business’s unique needs.

- Fixed-fee pricing

We have a variety of fixed fee programs that allow you to choose the amount of involvement based on the priorities we’ve discussed and your budget.

Virtual CFO Services Businesses Across the U.S.

While we work with businesses across industries, our specialization is working with privately held, 2nd stage companies with up to $50 million in sales.

Manufacturing presents unique challenges in costing, pricing and analysis, and we are passionate about helping small manufacturers win.

- Financial Data With a Forward Looking Focus

Your virtual CFO provides a clear analysis of your current financial data and how it affects your future plans for growth.

- Reliable Experience Across the U.S.

We proudly serve businesses across the country at a fraction of the cost of a full-time CFO.

A Business Owner Can’t Do Everything

One of the main problems faced by CEOs is handling multiple responsibilities. Running a business is a difficult task. Finance is complicated and having an expert virtual CFO on your team allows you to focus on growing and managing the business rather than worrying about the numbers.

- Benefits of a Virtual CFO

Flexibility, industry experience, and cost savings are among the many benefits a virtual CFO brings to the table.

- Ready to Hit the Ground Running

Onboarding a vCFOs is much quicker than hiring a full-time CFO. Our CFOs have the ability to quickly understand your business’s unique needs, formulate a plan and hit the ground running immediately after the start of engagement.

Forecasting and Budgeting Services

Our vCFOs are masters with numbers and measurement. We will set you up to measure and record key performance indicators. Using these measures of performance, we will determine how your spend matches up to your returns.

- Revise Budgets for Growth

Your vCFO will analyze your budget items to determine where there is bloat and where there is opportunity. Michigan CFO will work with you to determine how best to adjust your spending to maximize returns and minimize costs.

- Forecast for Clear Planning

Frequently Asked Questions About Virtual CFO Services

Why are small and medium enterprises choosing a virtual CFO?

Not every business can afford to hire a full C-suite to manage everyday affairs. But just because you can’t hire those people doesn’t mean the jobs they do go away.

Many business owners try to manage these things themselves, often changing course completely as problems arise. These sudden strategic shifts can wreak havoc on your employees, your customers, and your bottom line.

Most business owners can’t do it all, nor should they be expected to. If you’re spending all your time trying to teach yourself every administrative task that arises, you won’t have time to plan from the big picture. Hiring fractional and virtual C-suite consultants is a cost-effective alternative to hiring C-suite executives at a six figure salary.

In addition to cost savings, fractional and virtual CFOs have experience that most CFOs don’t. Because they work with several business clients at once, they are more attuned to common problems and solutions as well as structural shifts in economic conditions.

Should I hire a virtual CFO?

Every business has unique needs, but the same goals: to generate revenues by serving customers. There are many paths to revenue growth and choosing among them can be a challenge. A virtual CFO is a great resource for business strategy that can be wherever you are. If you find yourself in any of these situations, you may want to hire a virtual CFO:

- You’ve hit a growth plateau and no sales strategy is helping you expand

- Your office is remote, hybrid, or in multiple locations

- You base your financial and sales strategy on things you read from the internet

- There doesn’t seem to be any consistency in your cash flow from month to month

- The need for financial planning is getting in the way of focusing on things like new product offerings and building your brand

- Your inconsistent means of financial tracking or relying on your gut is no longer cutting it

- You need a clear picture of what business will look like in the future

A virtual CFO is there wherever you are to serve all your financial planning needs. If your business is struggling with managing finances, assessing business health, or projecting future growth, you need the services of a CFO. With virtual CFO services, any business can afford sound financial advice from a trained professional.

What does a virtual CFO do?

A virtual CFO can be wherever you are to handle your financial problems for you. Every business needs CFO services in some form or another in order to chart a path for future success. Hiring a dedicated CFO ensures that these needs are taken care of so you can focus on the work you love. With a virtual CFO, you get all these services at a fraction of the price of a traditional CFO. Services include:

- Establishing financial processes to produce accurate, useful and timely financial data for improved decision making

- Analyzing key performance indicators and profit points to identify opportunities for growth

- Creating financial models to forecast likely outcomes and present you with alternatives for growth

- Modelling new sales strategies and product offerings to draw in reliable income streams

Your virtual CFO will meet with you regularly to provide you new insights and plan for the future. If you find yourself struggling with financial management or developing new sales strategies, a virtual CFO can close the gap.

What does a virtual CFO cost?

The biggest advantage of a virtual CFO over a traditional CFO is the cost savings. A virtual CFO costs a fraction of what a traditional CFO would typically demand for a full time salary. While you may be paying well into six figures for a traditional CFO, a virtual CFO rates only run your business a few thousand a month.

At Michigan CFO Associates, we use a flexible fixed pricing model. You pay a flat rate for a given amount of contact time with your CFO that you can adjust as necessary. Our virtual CFOs are priced at four levels depending on your business’s CFO service needs.

Level 1 $2,100/mo One day a month check up. Ideal for businesses with less than 10 people. | Level 2 $3,200/mo Twice a month check up. Great for small but growing firms. | Level 3 $6,300/mo Once weekly CFO support. Our most common level of engagement. | Level 4 $11,500/mo Twice weekly meetings for larger operations or busy periods. |

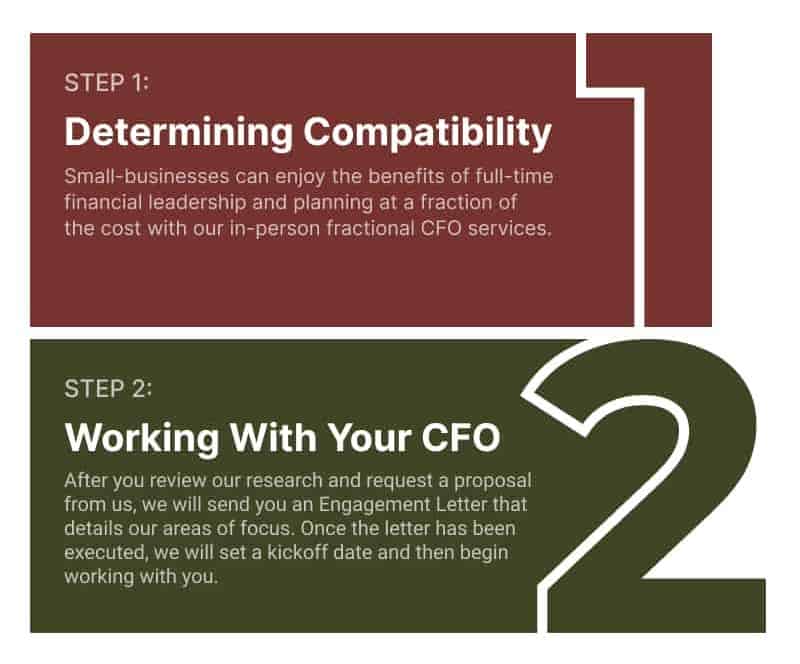

Our Two-Step Client Onboarding Process