What is a Virtual CFO?

A Guide for Businesses.

Understanding the Role of a CFO

Evolution of the Virtual CFO Concept

What Do Virtual CFOs Do?

Are you Considering Hiring a CFO?

Let's Discuss Your Challenges

What Our Clients Are Saying About Our Remote CFO Services

Rave Computer

Maestro Turgeon Group, LLC, Madison Heights, MI

B&P Process Equipment & Systems, LLC Saginaw, MI

Our Virtual CFO Services for U.S. Businesses

Looking for reliable small-business virtual CFO services?

Michigan CFO Associates can help.

Benefit from our proven methods of addressing the financial needs of small business owners in a cost-effective way

Deep Industry Knowledge

Our virtual CFOs have a deep manufacturing background and understand the solutions you need

Regain Control of Your Numbers

With accurate and timely financial data from our virtual CFOs, you control the numbers, not vice versa

Experience That Makes a Difference

Backed by over 15 years in the virtual CFO market, you can always depend on our expert CFO services

Your Strategic Financial Partner

Our virtual CFOs provide leadership, training, mentorship and consulting for your accounting staff

A Valuable Member of Your Team

Your virtual CFO seamlessly integrates into your team to provide holistic support

By the Numbers

18

Years in business

230+

Clients served and counting

3.9 Years

Average time clients work with our Virtual CFOs

9.6

NPS score from our clients

Cost of Hiring a Virtual CFO

-

Tailored to Your Financial Requirements

Our seasoned virtual CFOs dedicate their time to understanding and adapting to the specific needs of your business.

- Predetermined Cost Plans

We offer a range of set fee structures that give you the freedom to decide the level of engagement, based on the priorities we’ve established together and your financial limits.

The Difference Between CFO and Virtual CFO

- Financial Data With a Forward Looking Focus

Your virtual CFO provides a clear analysis of your current financial data and how it affects your future plans for growth.

- Reliable Experience Across the U.S.

We proudly serve businesses across the country at a fraction of the cost of a full-time CFO.

Qualifications Required to Be a Virtual CFO

- Advantages of a Virtual CFO

A virtual CFO provides advantages such as flexibility, extensive industry knowledge, and significant financial savings.

- Swiftly Operational and Effective

The process of integrating a virtual CFO into your organization is much faster than employing a full-time CFO. Our financial officers possess the skills to rapidly comprehend the distinct needs of your business, design a strategy, and become immediately effective once the collaboration commences.

Services Provided by a Virtual CFO

- Financial Planning and Analysis

- Cash Flow Management

- Budgeting

- Financial Reporting and Analysis

- Risk Management

- Strategic Financial Advice

- Collaborating with Internal Teams and Stakeholders

- Implementing Financial Systems and Processes

- Insights for Growth and Profitability

Conclusion

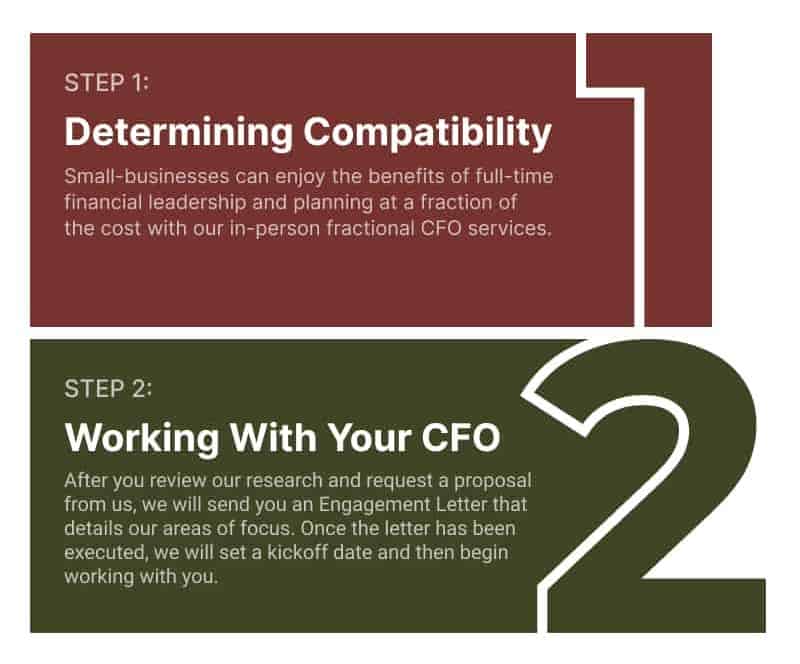

Our Two-Step Client Onboarding Process

Are you Considering Hiring a CFO?

Let's Discuss Your Challenges