Todd Rammler, President of Michigan CFO Associates, has been featured as a co-author in the book “30 Day Total Business Makeover”. In this book, Todd outlines the very same process used every day with clients to maximize profitability and cash flow. These strategies alone would be worth many, many times the price of the book. But as you can see by the title, the book is about a TOTAL business makeover. So in addition to financial strategies, you will also learn makeover secrets from experts in other fields such as Public Relations, Marketing, and Legal just to name a few.

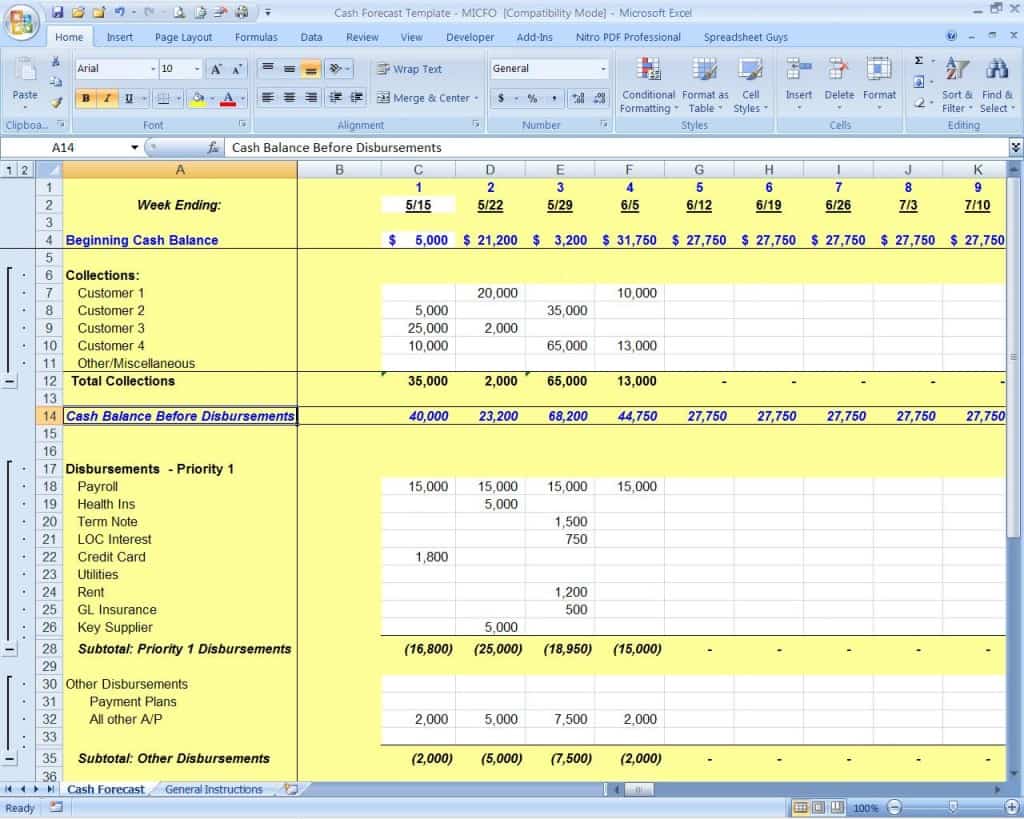

A simple to use spreadsheet for forecasting cash inflows and outflow for 6-8 weeks (or more). Can be used by the business owner or bookkeeper to look ahead and avoid unpleasant “surprises”. This tool also includes a section for calculating availability on a revolving or formula based line of credit, if applicable.

Note: This file will be delivered via email within 24 hours of checkout.

It is more important than ever to actively manage your business and ensure you weather the storm. That means you need to be behind the wheel heading to a specific target, along a specific route, instead of a ship at the mercy of the sea.

The best way to take control — and eliminate surprises — is through the use of appropriate financial statements. Not the kind of statements your CPA gives you once a year or once a quarter. You need financial statements that are designed specifically to do analysis and make decisions. And you’re not going to find those in a nicely bound report signed by your CPA.

This report will walk you through a no-nonsense approach to once-and-for-all understanding financial statements and using them to drive profitability & cash flow.

The CFO “GAP Analysis” is an evaluation of your company against best practices in 58 different categories. This analysis will identify any significant GAPS that could be dangerous to the ongoing success of your business. When completed, you will receive a written report detailing what we looked at, what we found (a red/yellow/green rating for each item), and any areas of concern along with recommended solutions. It’s a great integrity check that provides you with a practical assessment of financial strengths and weaknesses in your company, from the perspective of a CFO. You will find the exercise beneficial even if you’re not a candidate for our CFO services.

Price may vary based on company size. Price also includes a findings review meeting at our office.

Important note: Due to ongoing client engagements, we only perform 2 “GAP Analysis” services per month. The analysis’ are performed in the order that payments are received. If we receive your payment and have a 2 or more month backlog, we’ll contact you with the option of staying in que, or receiving a full refund.