Our Process

Step 1: Are we a fit for each other?

- An introductory phone call

- A self-assessment form, completed by your team

- An introductory meeting where we learn more about each other and discuss the results of the self-assessment form in detail

- In most cases, an opportunity to go through our extensive “CFO GAP Analysis” diagnostic assessment (note: there is a nominal charge for this)

- A detailed findings review meeting and report which includes our recommendations

At this point, you will receive our complete written assessment and recommendations, which you can choose to self-implement, or request a proposal if you’d like to work with us.

Step 2: Working with Michigan CFO Associates

After you’ve received the findings of our “CFO GAP Analysis” and have requested a proposal, we will provide you with an Engagement Letter that outlines the priorities we discussed in the findings review meeting. Once the Engagement Letter has been executed, we set a kickoff date and begin!

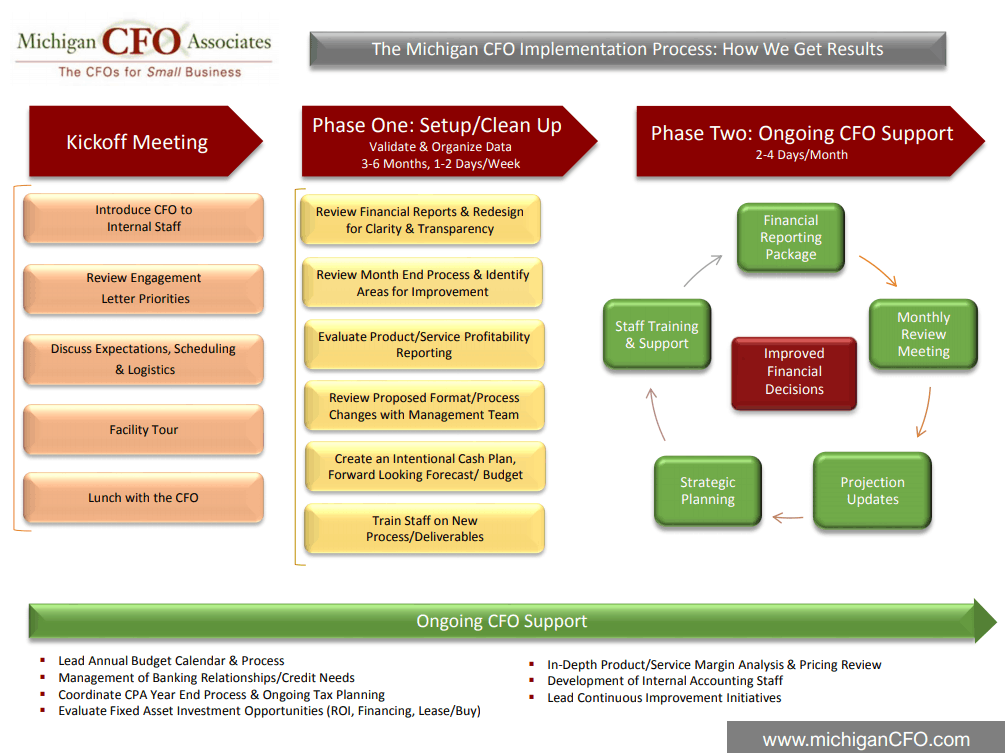

Once the Engagement Letter is executed, we follow the onboarding & delivery process in the chart to the left.

The Michigan CFO Implementation Process: How We Get Results

Our roadmap for working together is the Engagement Letter, which usually contains two distinct “phases”:

Phase One is our “Set up/Clean up” phase which generally lasts between 2 and 6 months for most businesses. Typically this phase includes re-formatting financial statements, reviewing/creating accounting processes, creating a budget/forecast, and setting up a cash plan.

Phase Two is our “Ongoing CFO Support” phase, where we (along with your team) execute and continuously improve the accounting process, reporting, and analysis in order to provide better data and make better decisions. During this phase the reporting package will evolve, we’ll lead monthly financial review meetings, and begin using the reports and data we’ve created in decision making. Also in Phase Two, your CFO will invite the Managing Partner to participate periodically in financial review meetings (2-3 times per year) to get an additional perspective on how the engagement is progressing.

While the order of specific priorities in either phase may change, the Engagement Letter is our underlying workplan. Your CFO will complete a written Engagement Status Update form quarterly to document the engagement progress, next steps, concerns and any roadblocks encountered. This is intended to provide consistent, clear communication to you and your leadership team.